We wanted to share today's Trulia Blog on our site because we feel they are true and we have heard them with our buyers and sellers as well!

Like anything else, real estate has its urban legends, its stories that get told so often they seem like they must be true. But unlike urban legends about exploding Pop Rocks or the origins of Jennifer Aniston’s ‘Friends’-era haircut, real estate myths have the potential to create fear, panic, paralysis and all sorts of other decision glitches.

The recent market upturn, coming on the heels of 6 years of near-Depression, has given rise to its own set of real estate myths. Here is a handful, along with some ways you can and should rethink them.

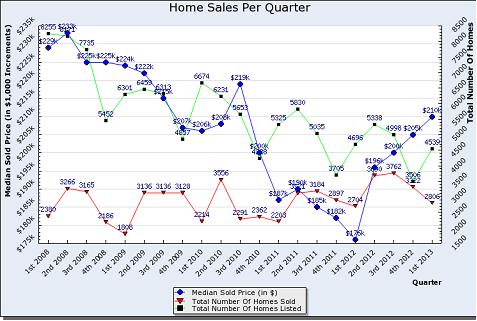

Myth #1. It’s recovering too fast. According to the Standard & Poor’s/Case-Shiller home-price index, American home prices increased an average of 10.6 percent between March 2012 and March 2013. Twelve of the 20 major metro areas tracked had year-over-year median home price increases in the double-digits. The list was topped by Phoenix, San Francisco and Las Vegas, all of which saw 20 percent or greater annual home price increases.

That seems crazy fast, to some. So crazy, in fact, that it’s created the fear that the current market’s exuberance will re-create the steep incline and decline in home values that we all remember not-so-fondly from the last boom-bust cycle.

Here’s the deal: markets have cycles, period. So I can guarantee you that the ups and downs will repeat, though hopefully not to such extremes. Part of what made the last down cycle so extreme was the fact that lenders were greenlighting massive home loans to borrowers without requiring them to document their ability to pay for the property over the long term. Buyers, in turn, overextended themselves regularly. Today’s loans are allowing people to buy without putting much down, but I haven’t seen almost any examples of the fully stated income or so-called “liar’s” loans that really got people in trouble. (Yet.)

Here’s the other thing: the data can be a bit misleading. When an area’s home values have been very, very depressed for long, it simply doesn’t take that vast of an uptick to generate double-digit percentage point increases. When you look at the top five recovery markets, according to the Case-Shiller, four of them: Phoenix, Las Vegas, Miami and Tampa – ranked among the hardest hit markets in the foreclosure crisis and resulting downturn. (San Francisco was the anomaly.) When you look at other markets that skated through the recession relatively unscathed, like New York, you see the percentage point increase year-over-year was much less impressive/ less scary (depending on your outlook), at 2.6 percent.

Myth #2. Investors are driving demand. In some areas, investors are buying up lots of low-priced homes. From big Wall Street investment groups to Mom-and-Pop investors, people who don’t plan to live in the homes they’re buying were responsible for about 20% of May home sales. But this number is actually on a downward path – investors were responsible for 22% of home sales in April, and investor activity should continue to decline as prices increase, putting a cap on the profits investors can realize.

While investor activity is declining, buyer demand is increasing, as evidenced by increasing numbers of cash transactions, offers per property and speed of homes leaving the market.

First-time buyers are responsible for 36% of current buyer activity and repeat homeowners for over 43%. Investors have been active, but by no means are they responsible for creating the intense buyer demand that now characterizes the market.

Myth #3. Sellers are stuck. This time, let’s start with what’s true. Many, many sellers in hot markets are in the midst of an exasperating Catch-22: they can finally sell their homes, which have been underwater for years. But now they struggle to buy, amidst the multiple offer mania – some report having to make offers on dozens of homes, or even having to rent a place until they can buy one.

As I see it, sellers aren’t stuck as much as they are being forced into being strategic about sequencing their transactions and setting up their deal points. During the recession, millions of sellers had no equity – or negative equity. That meant they couldn’t sell, which meant they didn’t have the money to buy – heck, many couldn’t even refinance. That’s what I call stuck. Now, they have the option to pull cash out to buy first, the option to refinance and stay put, and the option to sell – period. So for my dollar, today’s sellers are nowhere near stuck, compared with the truly stuck sellers of yesteryear.

Most of the sellers who have recently, truly gotten stuck (i.e., sellers who’ve been forced to rent until they could successfully buy) ended up in that situation because they listed their homes first, unaware that the market truly had shifted and that their home would fly off the market. Now, we know. So, if you’re selling in a super-hot market, work with your agent to put a strategy in place. Consider buying first, if you have the means or can get them. Or list your home with a Seller’s Contingency or a rent-back agreement (where your home’s buyer rents it back to you for a short time), to buy yourself some extra time to score a new place. Your agent and mortgage pros can help.

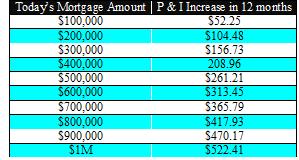

Myth #4. Rates are through the roof. Have mortgage interest rates gone up? Yes. Is the Fed signaling they intend to raise rates, too? Yes - in 2015. (Not exactly tomorrow.)

Last week’s reported 30 year mortgage rates were 3.94 percent, and 15-year rates were right around 3%. Given that the record low rates clocked in at 3.31 (30-year) and 2.62 (15-year), even today’s higher rates are not worth your worry. Nor is an increase of rates likely to cause all the pent-up buyer demand of the last few years to dissipate. My Dad used to remind me that people bought homes when rates were 14% in the 80’s, and they will buy them now, even as they inch up – because they need and want places to live.

Myth #5. Foreclosures are a thing of the past. Through the recession, many banks and mortgage servicers began to hold hundreds of thousands of foreclosed homes off the market to avoid flooding it, depressing prices even further than they already were. And even now, these institutions continue to trickle them onto the market, rather than creating a deluge of home inventory. Additionally, mortgage regulators now allow servicers to rent out REOs, versus selling them, and to hold them as long as 5 or 10 years following foreclosure, if needed.

While we are seeing a steep decline in the number of newly foreclosured homes, we can expect to have a higher-than-average number of foreclosed homes – REOs – on the market for some years to come. This so-called “shadow inventory” had declined over 10% nationwide between January 2012 and January 2013. And with the uptick in demand, we should continue to see this so-called “shadow inventory” of homes decline as banks take the opportunity to get these homes off their books.

.jpg)

Recently the research team at the National Association of Realtors (NAR) looked at studies done by the Bureau of Economic Analysis, the Census Bureau, Macroeconomic Advisors and the Joint Center for Housing Studies at Harvard. After reviewing the data, they determined the total economic impact of a typical home sale in the United States is an astonishing $56,464.

Recently the research team at the National Association of Realtors (NAR) looked at studies done by the Bureau of Economic Analysis, the Census Bureau, Macroeconomic Advisors and the Joint Center for Housing Studies at Harvard. After reviewing the data, they determined the total economic impact of a typical home sale in the United States is an astonishing $56,464.