Salt Lake County Home Median Price and How Much Waiting Can Cost You

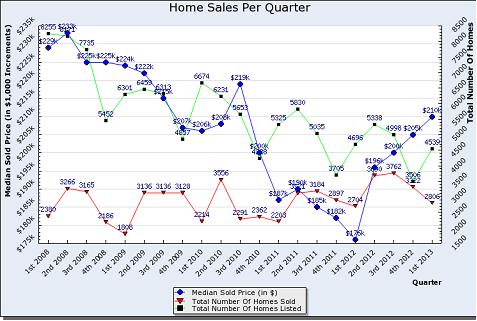

In Salt Lake County the Median home price has risen from a low in the first quarter of 2012 of $176,000 to $210,000 the first quarter of 2013! How much has your dream home gone up over the last year? Now compound that with interest rates going up….

This  chart represents the Median home prices for homes sold in Salt Lake county since 1st quarter of 2008 to fist quarter of 2013 along with total homes sold and listed in the same period. If you want to know what your neighborhood is doing call, text or email us today! We also wanted to share todays kcm blog with you since it goes along with the Salt Lake Median home data.

chart represents the Median home prices for homes sold in Salt Lake county since 1st quarter of 2008 to fist quarter of 2013 along with total homes sold and listed in the same period. If you want to know what your neighborhood is doing call, text or email us today! We also wanted to share todays kcm blog with you since it goes along with the Salt Lake Median home data.

KCM posted this today and it makes perfect sense!

Link to KCM's post:

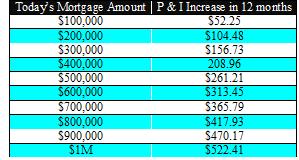

Total Increase a Buyer May Pay if They Wait

Posted: 23 May 2013 04:00 AM PDT

Earlier in the Week, we explained that experts have projected that the U.S. home prices will appreciate by approximately 5% in 2013. We also revealed the Mortgage Bankers Association, Fannie Mae and the National Association of Realtors have all projected that the 30 year mortgage rate will be at least 4% by the end of 2013. If we assume that prices and interest rates will rise as projected, here is the monthly difference a buyer may pay if they wait a year.