Salt Lake Housing Market Data

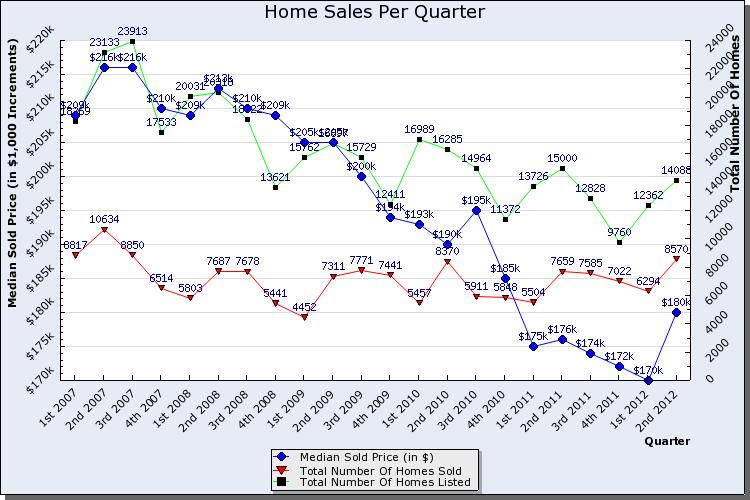

We truly believe now is a great time to buy a home. Today KCM showed the chart below along with the headline:

Is Real Estate better off then it was four years ago?

That depends on whether you are selling or buying...

|

Date |

Median Sales price per NAR |

30 Year mortgage rate per Freddie Mac Rate |

Payment Principle and Interest Only |

|

August 2008 |

$210,900 |

6.48% |

$1,330.26 |

|

August 2012 |

$188,100 |

3.59% |

$854.13 |

In our opinion the even bigger concern buyers should consider is were will the Salt Lake Housing market be in the next 6 months, year or five years….

No one knows what the future holds but if my son was 18 he would be buying a home today!

No one knows what the future holds but if my son was 18 he would be buying a home today!

The Jones team is happy to provide you free market data based upon your situation, price range, and area. We will also tell you honestly if now is not the best time to jump into the market based upon the data.

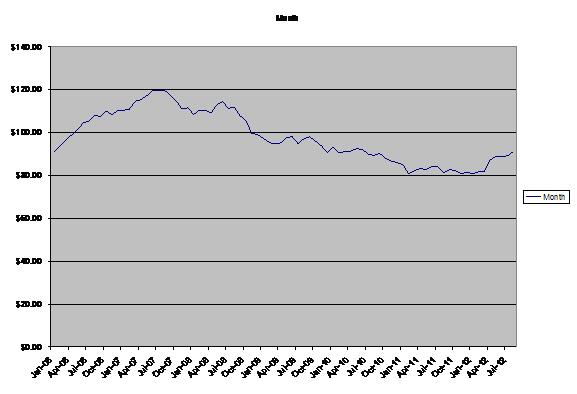

Call the Jones team today to see what your home is worth or what the blue line is doing in your price range and area of interest you may be surprised!